Prop Firm Digital Trading Planner (iPad Compatible – GoodNotes Ready)

Unlock elite discipline, structure, and consistency with the all-in-one Prop Firm Digital Trading Planner — built specifically for traders tackling prop firm evaluations and funded accounts.

Whether you’re preparing for your next challenge or managing multiple funded accounts, this sleek and powerful planner gives you the tools to trade smarter, not harder.

What’s Inside:

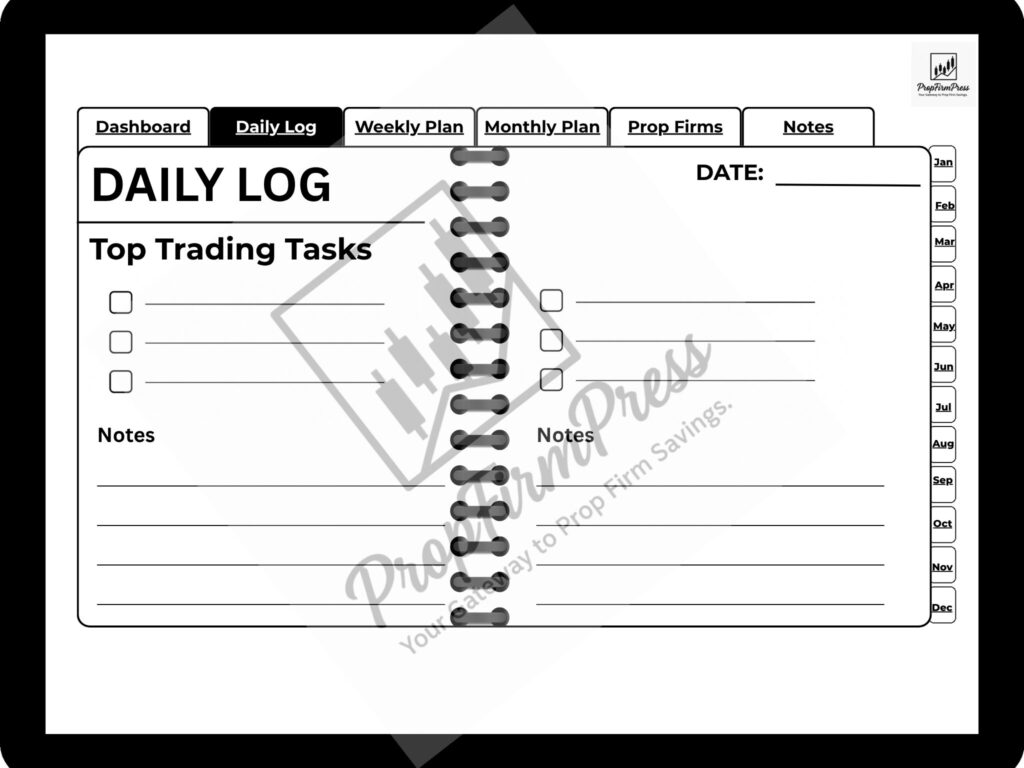

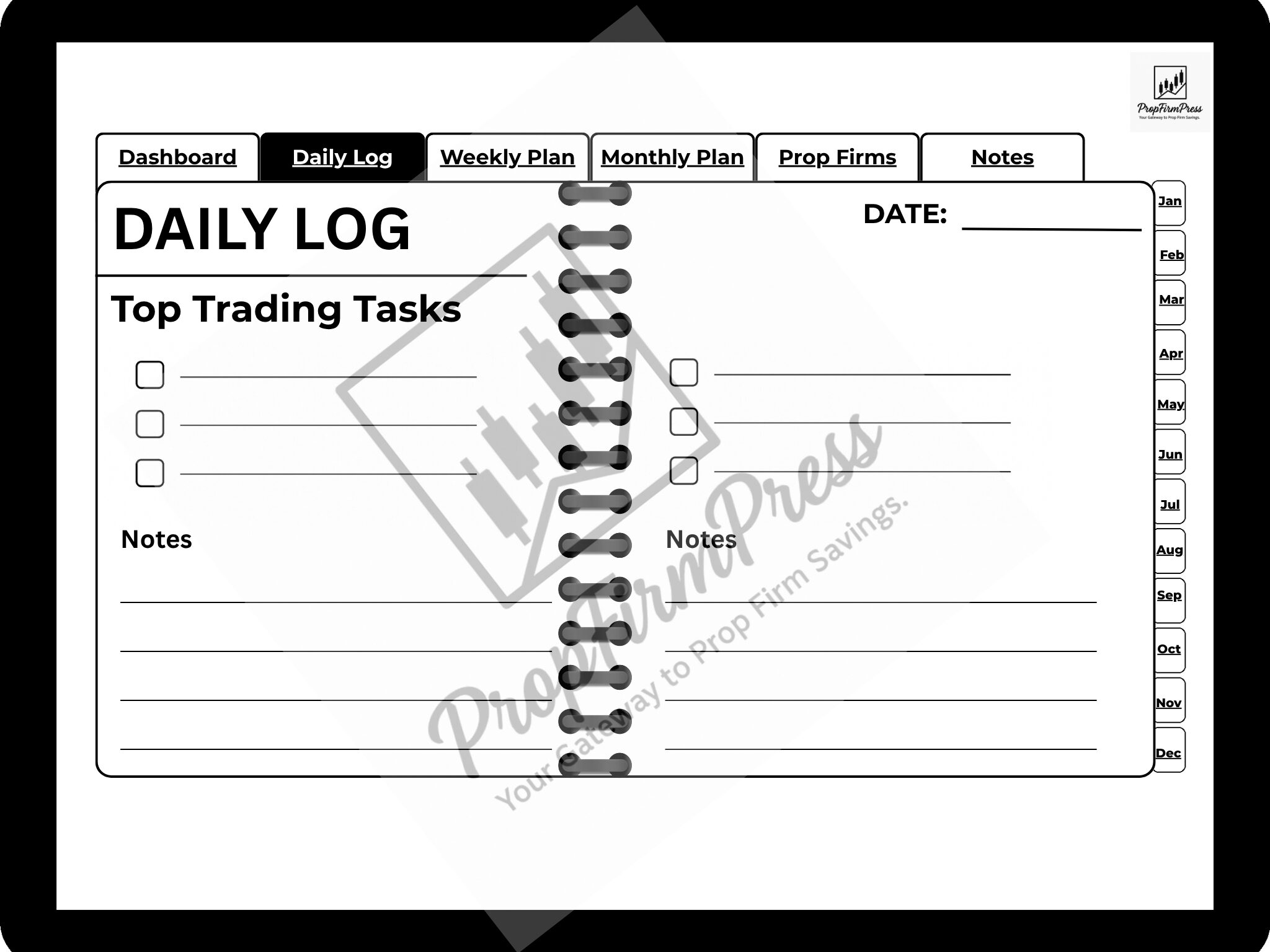

- ✅ 30 Daily Log Sheets — plan and review each trading day

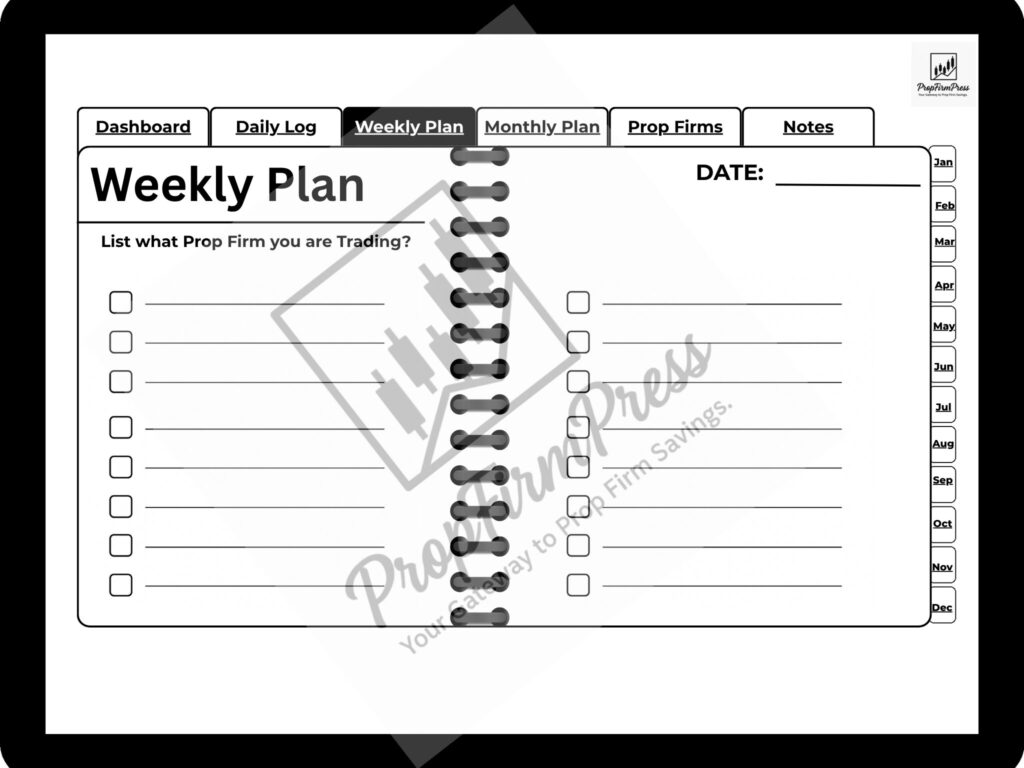

- ✅ 20 Weekly Plan Sheets — design your weekly strategy and routine

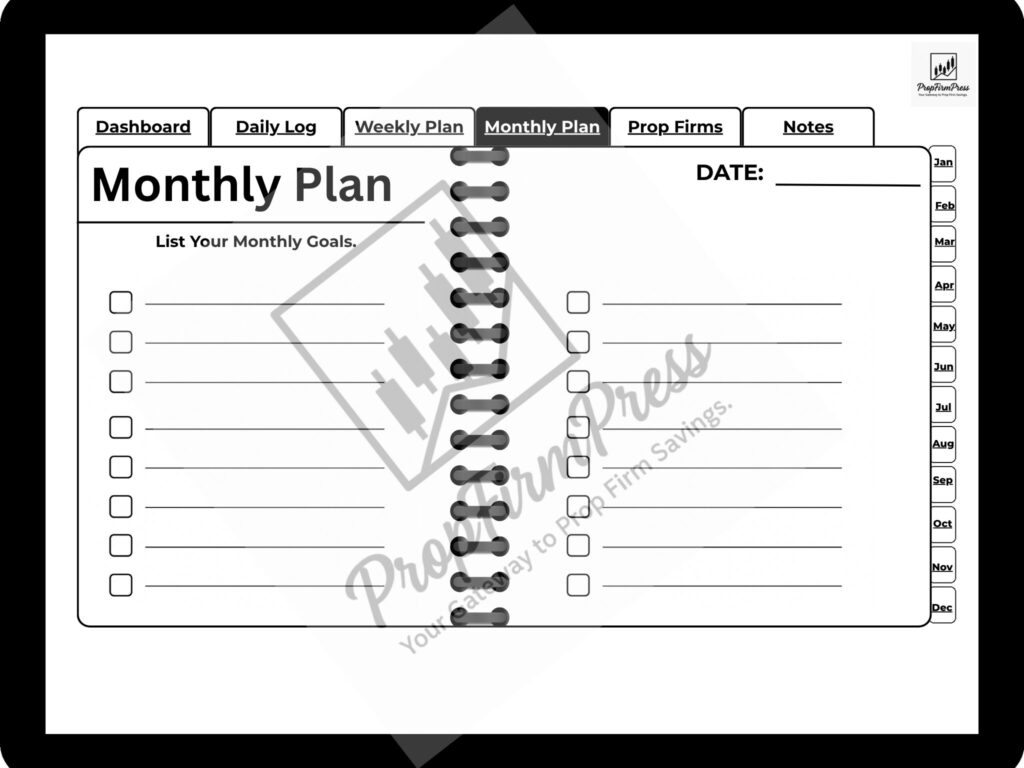

- ✅ 12 Monthly Planning Pages (Jan–Dec) — set goals, affirmations, and mindset themes

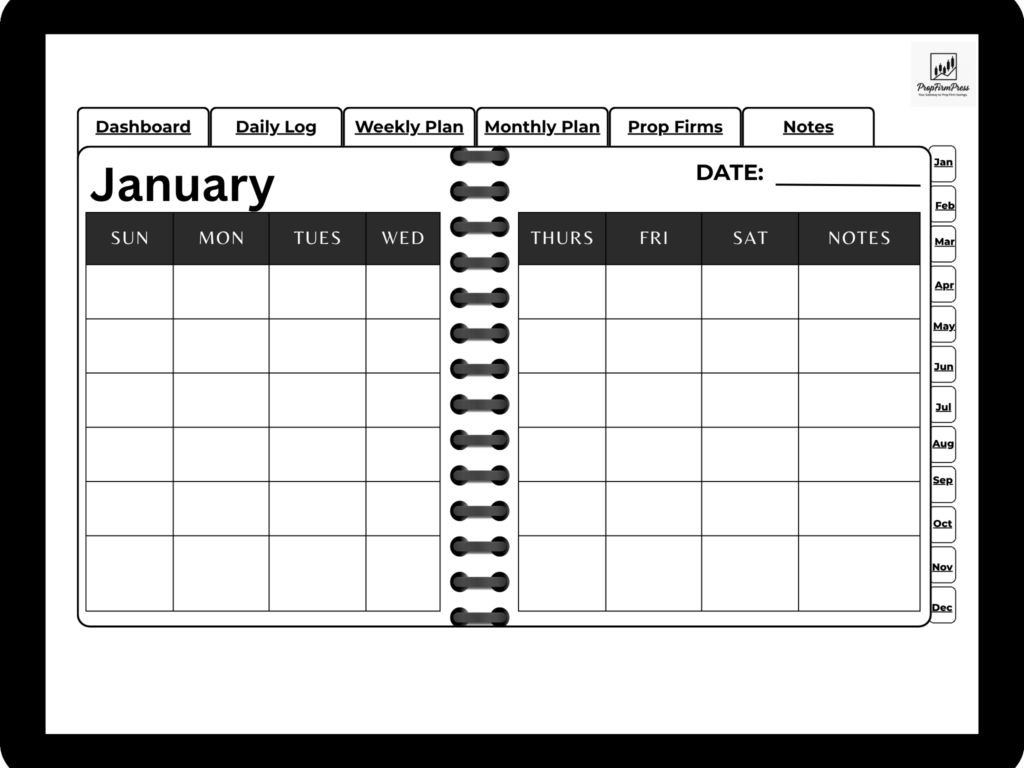

- ✅ 12-Month Blank Calendar (Undated) — customize your own monthly view for any year

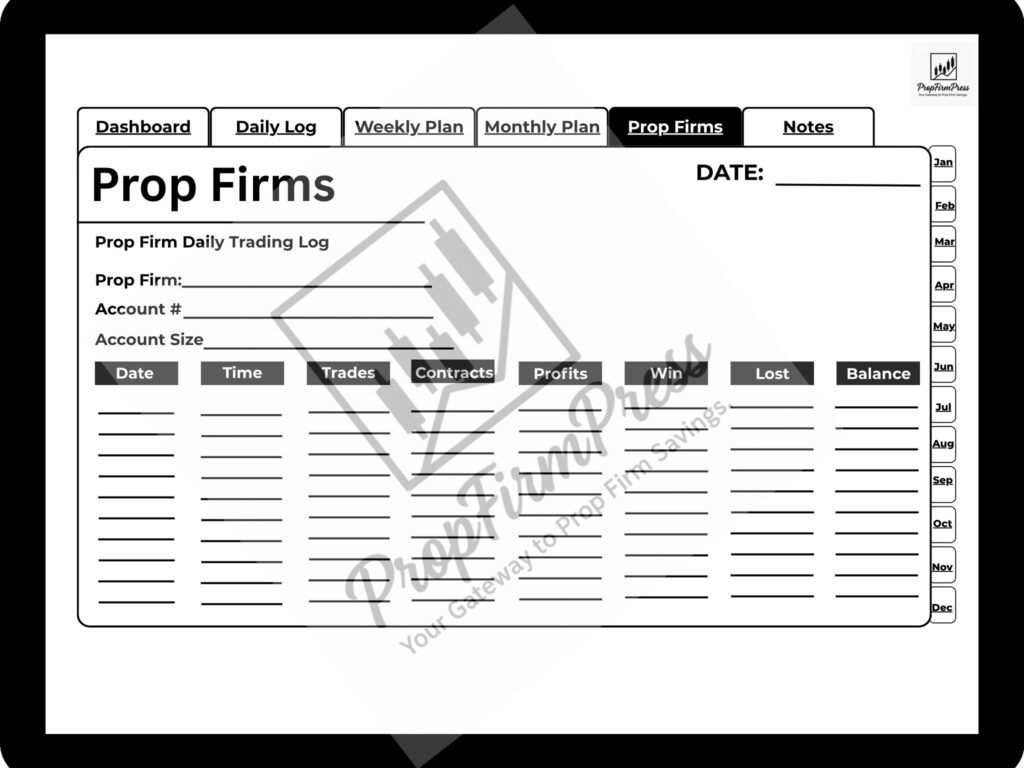

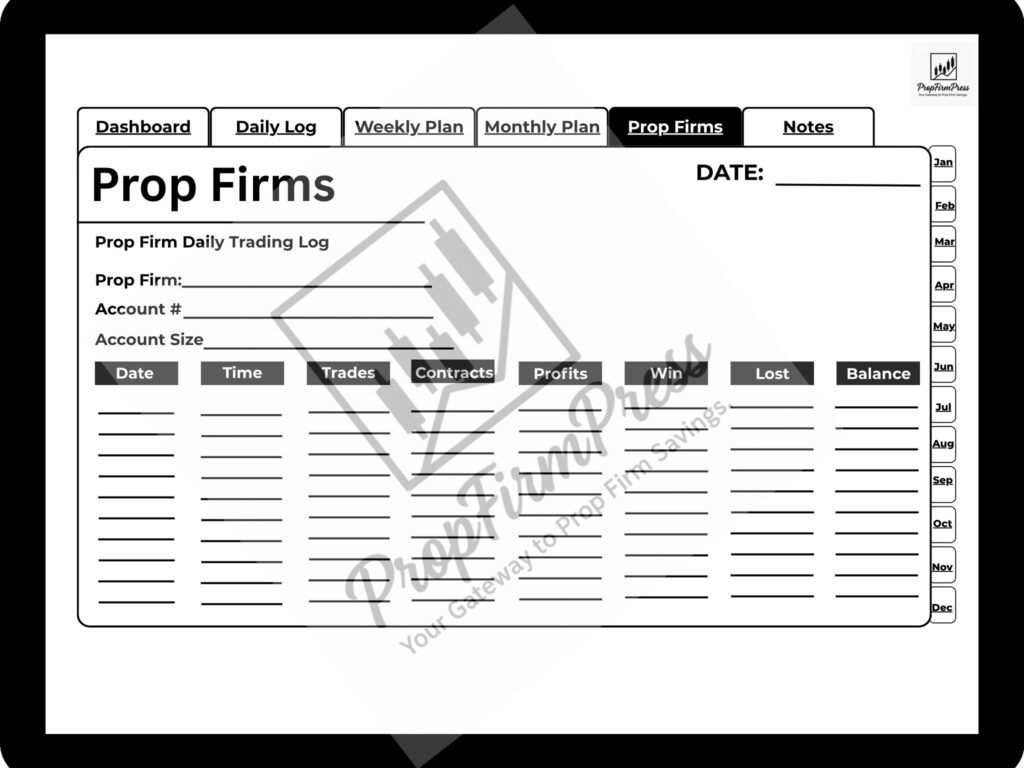

- ✅ 20 Prop Firm Tracking Sheets — organize your challenge and funded accounts

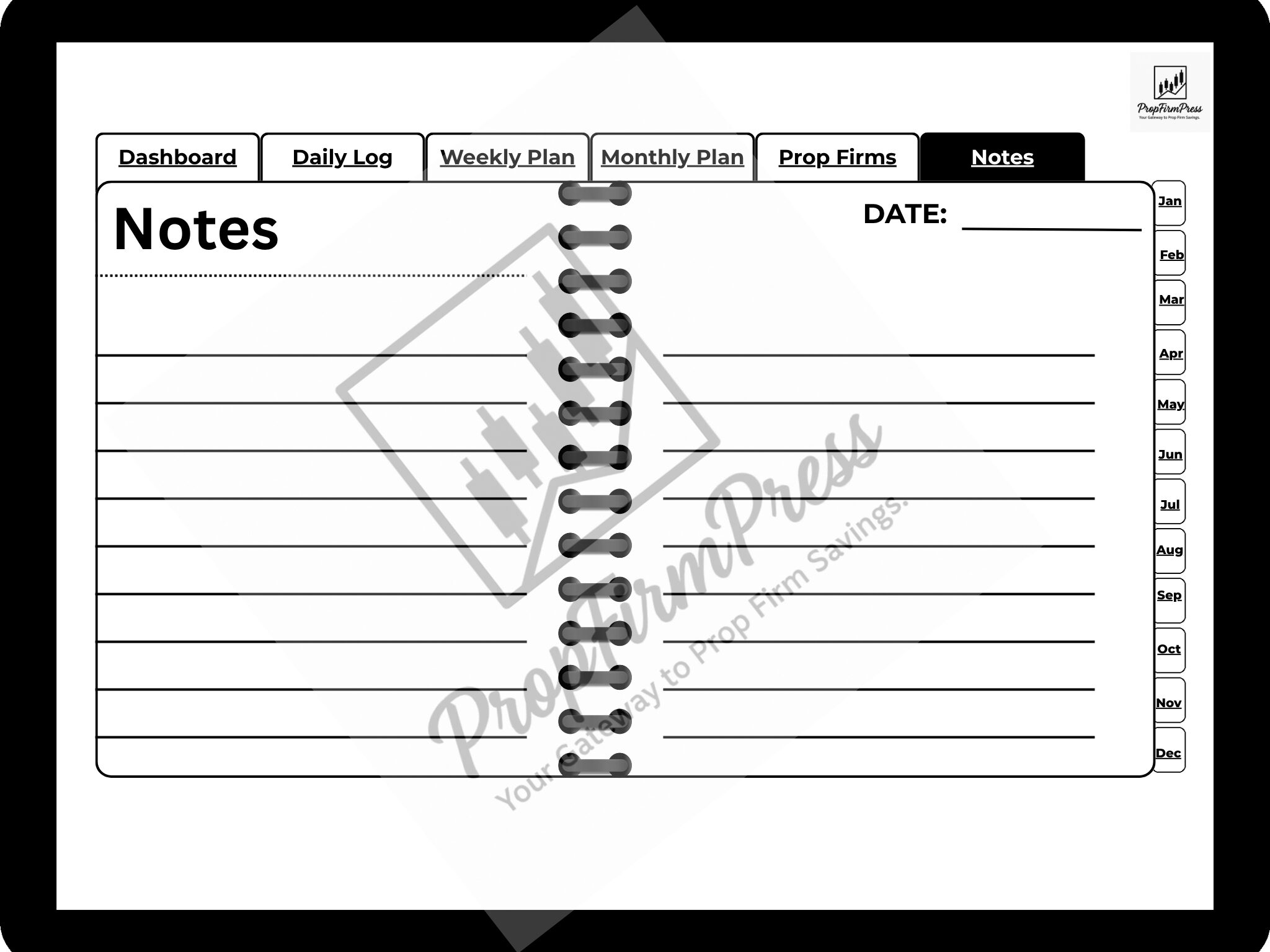

- ✅ 2 Notes Sheets — document key lessons, setups, or ideas

- ✅ Hyperlinked Navigation — jump to any section instantly on your iPad

Designed for iPad apps like GoodNotes and Notability. Fully clickable, minimalist, and crafted in 2048×1536 landscape format for a professional digital journaling experience.

Why Traders Love It:

- Built for real prop firm traders — whether you’re using Bulenox, Funded Trading Plus, Topstep, Earn2Trade, or others

- Helps you stay consistent, focused, and emotionally sharp

- Replaces cluttered spreadsheets with clean, structured tracking

- Reinforces winning habits through short daily and weekly reflections

- Works great for part-time or full-time traders managing multiple accounts

Your edge isn’t just strategy—it’s structure.

The Prop Firm Digital Trading Planner turns your trading into a system you can trust every day.

Start journaling like a funded professional.

All sales are final. Due to the digital nature of this product, no refunds will be issued.

PROP FIRM DIGITAL TRADING PLANNER

A Complete System for Getting Funded and Staying Funded Longer

Every serious prop firm trader knows that consistency is king. But consistency doesn’t come from talent—it comes from systems. The Prop Firm Digital Trading Planner was created to help traders stay organized, focused, and mentally sharp across every stage of their funding journey, from evaluations to payouts.

Whether you’re prepping for a new challenge or managing multiple funded accounts, this all-in-one planner turns disorganized trading habits into repeatable performance. Let’s explore how it helps you level up at every stage of your prop trading career—and how to put it to use right away.

A Complete System for Getting Funded and Staying Funded Longer

The Digital Alternative to Chaos

Most traders start with excitement—charts open, targets set, and motivation high. But by Day 5 of a prop firm challenge, bad habits start creeping in:

- Skipping your pre-trade checklist

- Taking revenge trades after losses

- Ignoring rules that seemed “easy” at the start

It doesn’t take long before the evaluation fails or the funded account is breached.

This planner is designed to prevent that slide.

It’s not just a journal—it’s a digital tool built with the structure, checklists, and review systems that funded traders need to maintain edge under pressure.

Accessible via iPad with GoodNotes, Notability, or any interactive PDF app, the Prop Firm Digital Trading Planner turns your tablet into a command center for accountability.

What’s Inside the Planner

This isn’t a “blank notebook.” It’s a guided trading system across four core planning sections:

- 30 Daily Log Sheets – Structured pages to track daily setups, emotional states, entry/exits, and post-trade lessons.

- 20 Weekly Plan Sheets – Reflect on the week behind, prepare for the one ahead, and set goals in alignment with prop firm rules.

- January–December Monthly Planning Pages – Plan macro goals, reset your mindset, and review performance themes.

- 20 Prop Firm Tracker Sheets – Designed to track your evaluations, scaling progress, and funded accounts in one place.

Plus, it includes a fully linked, clickable dashboard that lets you jump to any section instantly—a must for efficient use on tablets.

Why Funded Traders Love This Planner

This planner was built with real traders in mind. Here’s what makes it different from other digital journals:

- Designed for Prop Firms – Built around the structure of popular firms like Topstep, Funded Trading Plus, and Bulenox.

- Challenge-Ready – Pages prompt you to log rule compliance, max loss, profit targets, and daily discipline.

- Distraction-Free Design – Clean black-and-white layout. No fluff, no noise. Just what you need.

- Mobile Performance – Built for iPad and touchscreen use; works seamlessly in GoodNotes or Notability.

But what really makes it powerful is how it integrates with your trading process—especially if you’re treating this like a real career.

Let’s now look deeper into how each core section can transform your trading performance.

How to Use the Prop Firm Digital Trading Planner for Challenge Prep

Challenge prep is where most traders fall short. They sign up, skim the rules, and jump straight into trading. But real pros treat prep as a mission in itself.

With the Prop Firm Digital Trading Planner, your challenge prep begins with the Weekly Plan section. Here, you’ll set your trading schedule, list market sessions you’ll participate in, and define your trading “non-negotiables.”

Then, the Daily Log pages come into play.

Each morning, you’ll document your:

- Top 3 market conditions to watch

- Daily risk limit

- Key levels from pre-market analysis

You’ll also walk through pre-trade routines and filter setups that match your strategy.

These small, consistent steps make a huge difference. By visually seeing your plan—and holding yourself accountable to it—you’ll be miles ahead of traders who just “wing it.”

Using the planner for challenge prep ensures you’re not reacting to the market emotionally. You’re following a mission plan that already accounts for your edge, risk tolerance, and the firm’s rules.

How to Track Funded Account Performance Using the Prop Firm Planner

Passing the evaluation is only half the battle. Staying funded is where most traders break down.

That’s why the Prop Firm Digital Trading Planner includes 20 dedicated Prop Firm sheets—each tailored to track individual accounts, challenge resets, scaling updates, and payout milestones.

Use these sheets to log:

- Funded account start date

- Payout frequency and success

- Violations or close calls

- Performance stats like max drawdown, average win/loss

- Notes on emotional discipline (e.g., Did you revenge trade after a loss?)

Many funded traders fall into complacency after hitting their first payout. This planner forces you to keep tracking metrics that predict long-term success—not just short-term gains.

It also lets you reflect on patterns: Are you risking more after payouts? Are you slipping during weeks with economic news? The answers are there—if you journal them.

How to Combine the Digital Planner with Your Prop Firm Dashboard

Your prop firm dashboard gives you numbers: daily PnL, drawdowns, hit rate. But what it doesn’t give you is context.

That’s where this planner comes in.

Use your dashboard stats as a reference—then go into your Daily Log sheets to analyze why things happened.

- Got a 3% drawdown in one day? Check your planner log—did you break your stop loss rules?

- Saw a spike in profitability? What did your weekly review say about strategy changes?

This is the power of combining tech with discipline. The planner doesn’t replace your dashboard—it completes it.

In fact, many traders print or screenshot their prop firm stats and paste them into the Notes section each week for visual reference. It’s a hybrid system: part analog, part digital, all built for performance.

This section expresses gratitude to users for their engagement, support, or action taken. It reassures them of your commitment to providing value and building a lasting relationship.

Build a system that lets you trade better, longer, and with more confidence.

How to Design a Weekly Trading Routine with the Prop Firm Planner

Most traders treat routines as “optional.” But funded traders know that routine is edge.

The Weekly Plan pages inside the planner help you architect your entire trading week before Monday even begins.

Each sheet prompts you to:

- Define your target sessions (e.g., London, New York open)

- Pick your main instruments to focus on

- Choose one rule to reinforce (e.g., “No trades after 11am”)

- Forecast potential news catalysts to avoid or plan for

Once completed, this routine lives as your roadmap for the week. It helps you avoid distraction, overtrading, and burnout.

You can also reflect on this sheet every Sunday night. Ask yourself: “Did I stick to the plan?” If not—why?

Over time, these weekly reflections become data-rich logs of your discipline, strategy evolution, and market awareness.

How the Prop Firm Digital Trading Planner Can Improve Your Psychology

Mindset is often the difference between a $0 payout and scaling to a $100K account.

Traders don’t just fail because they misread a chart—they fail because they:

- Chased revenge trades

- Over-leveraged after a win

- Froze during high-volatility moments

The Prop Firm Digital Trading Planner is built to stop those emotional loops.

Here’s how:

- Checklists at the start of each Daily Log page remind you to review risk, news, and market context.

- Notes sections encourage emotional journaling after each trade, creating mindfulness.

- Affirmations and monthly reflections help reset your psychology at scale.

By building the habit of checking in with yourself—daily, weekly, and monthly—you’re not just becoming a better trader. You’re becoming a calmer, more resilient decision-maker.

And that’s the trader prop firms want to fund again and again.

Why the Name Matters: Built for Funded Traders

Every element of this planner is tailored to the real needs of a modern prop trader. From the terminology, to the layout, to the digital format—it was designed with one goal in mind:

To help you win and stay funded.

That’s why the name “Prop Firm Digital Trading Planner” matters. It speaks directly to:

- Funded traders who want more structure

- Aspiring traders in evaluation phases

- Consistency-seekers in a sea of emotional trading

It’s not generic. It’s not corporate. It’s built for you.