The Wall Street to Bowling Green Edition: A Printable Financial Planner for Market Mastery

Are you tired of making emotional trading decisions that sabotage your success? Do you have a strategy, but lack the discipline to follow it consistently? It’s time to stop trading like a hobbyist and start operating like a Wall Street professional.

The Wall Street to Bowling Green Trader’s Journal symbolizes the journey every trader must take: from the chaos of the open market to the focused discipline of a seasoned pro. This isn’t just another planner. It’s a complete, printable ecosystem designed to forge discipline, provide analytical clarity, and help you master the single most critical factor in your success—your mindset.

Your All-in-One System for Trading Excellence

Your All-in-One System for Trading Excellence

This meticulously crafted 152-page journal is your daily partner in building a professional-grade trading routine. Every page is designed to address a critical component of trading success. Instantly download and print in both full-size (8.5″ x 11.5″) and A5-style (5.8″ x 8.3″) formats.

- Core Planning Suite: Seamlessly integrate your trading into your life with undated Daily, Weekly, and Monthly Planners.

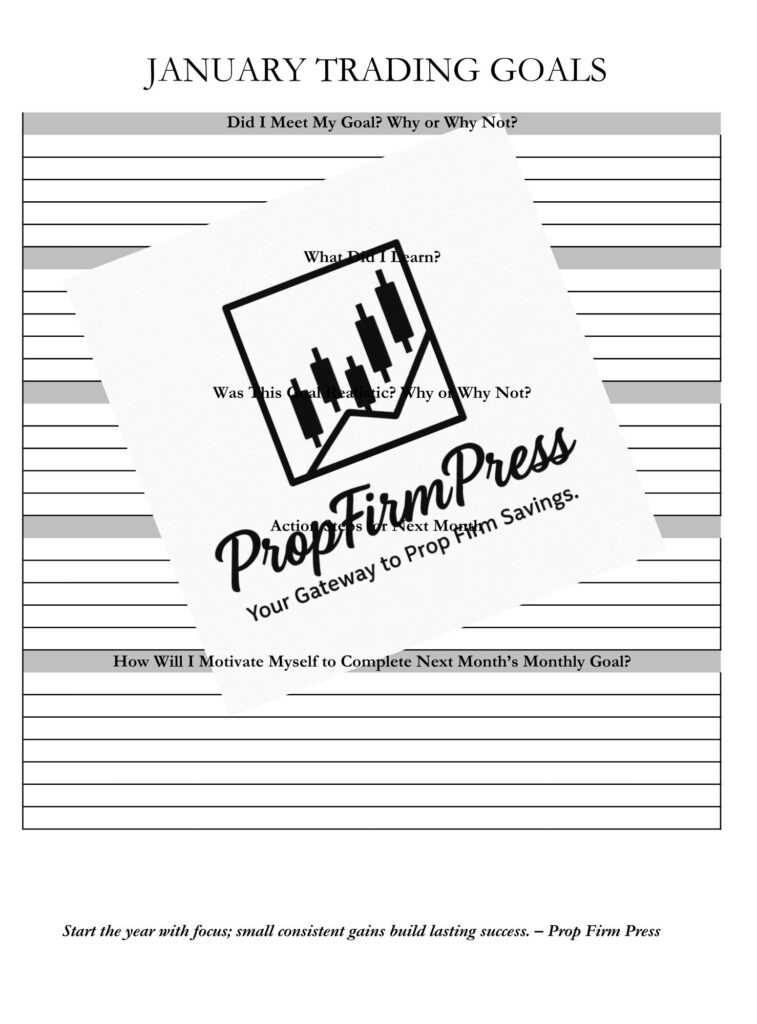

- Monthly Trading Goals: Set clear, actionable, and realistic targets. Our guided monthly goal sheets help you define what you want to achieve, reflect on your performance, and plan concrete action steps for the month ahead.

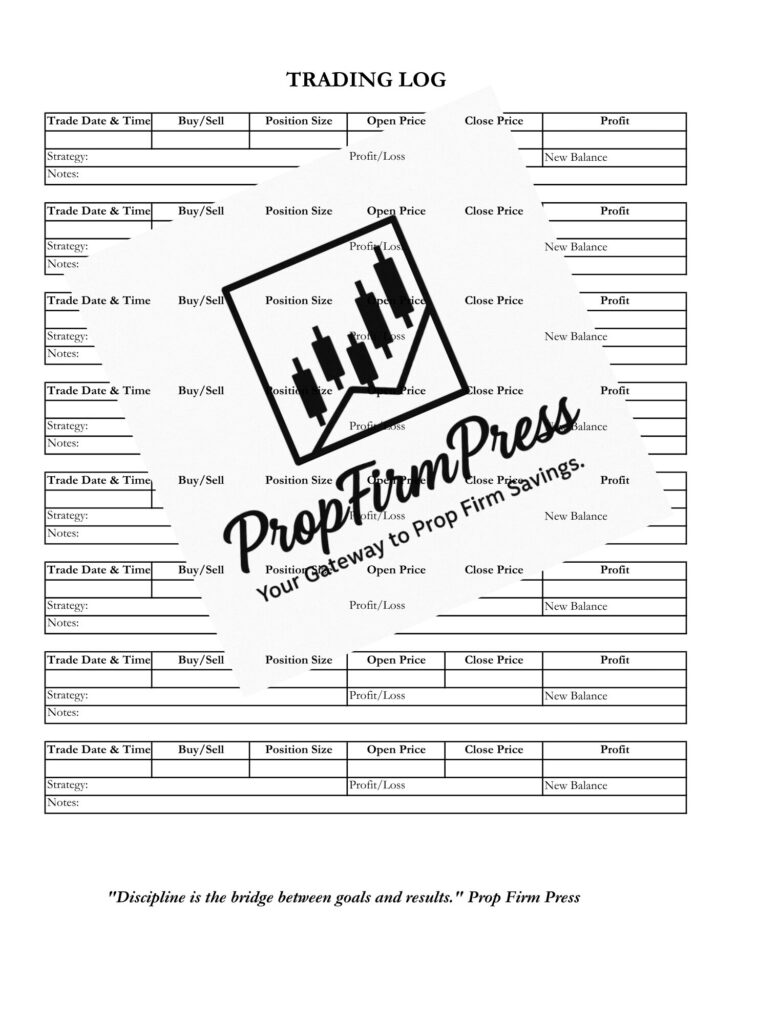

- Precision Trading Log: Go beyond basic profit and loss. Track every crucial variable—date, time, strategy, position size, open/close price, and new balance—to get a granular view of your performance.

- The Trading Rules Vault: Success in the market is built on a foundation of rules. Codify your personal trading plan, entry/exit criteria, and risk management protocols to ensure you follow them with unwavering discipline.

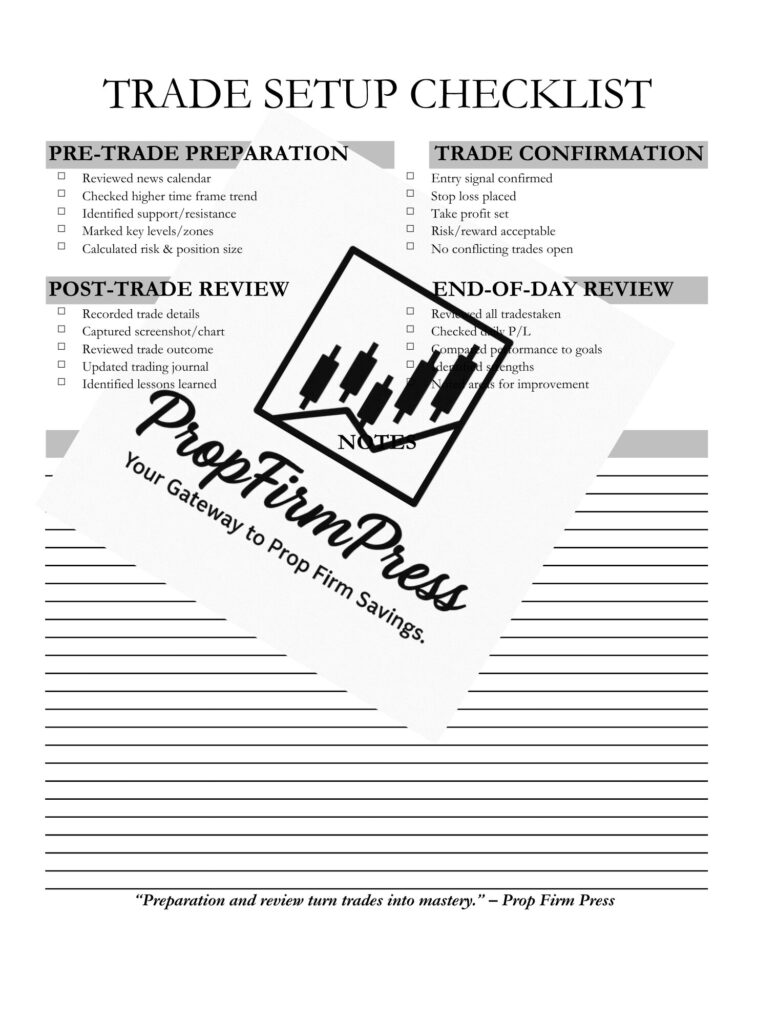

- The Trade Setup Checklist: Eliminate guesswork and enforce consistency. This powerful checklist guides you through Pre-Trade Preparation, Trade Confirmation, Post-Trade Review, and End-of-Day Analysis to ensure you never miss a critical step.

- Weekly Trading Summary: Get a “trader’s-eye-view” of your weekly performance. The summary sheet helps you break down trades taken, wins, losses, and P/L by day, and includes vital reflection prompts on what worked, what didn’t, and the lessons learned.

- Dedicated Prop Firm Challenge Tracker: Are you taking on a funding challenge? This is your secret weapon. Track your account size, profit targets, max daily loss, and overall drawdown in one clean interface to stay within the rules and secure your funded account.

- The Emotions & Psychology Log: Conquer fear and greed. This unique log helps you track pre-market mood, stress levels, and the specific emotions you feel before, during, and after a trade, allowing you to finally pinpoint and correct psychological triggers.

- In-Depth Trade Review Sheet: Master your strategy by mastering your past trades. This sheet prompts you to analyze the market conditions, the setup, the risk-to-reward ratio, and whether you followed your plan—turning every trade into a valuable lesson.

- Trading Expenses Tracker: Treat your trading like a business. Keep meticulous records of all your trading-related costs—from software and data fees to education—to maximize your profits and stay organized for tax time.

- Motivational Mindset Coloring Pages: When market pressure builds, a mental reset is key. Our beautifully illustrated, trading-themed coloring pages—with affirmations like “Discipline Over Desire” and “Plan the Trade, Trade the Plan”—are designed to help you de-stress, refocus, and internalize the core principles of a winning mindset.

Please Note: Due to the digital nature of this product, all sales are final. No refunds, cancellations, or exchanges will be provided. Please review the product description carefully before making a purchase.

This Journal Was Built For You If:

- You are an aspiring or funded prop firm trader who must adhere to strict rules.

- You are a day trader or swing trader in Stocks, Forex, Crypto, or Futures.

- You are a developing trader committed to building a foundation of discipline.

- You are an experienced investor looking to sharpen your psychological edge.

Download Your Journal Instantly and Forge Your Path to Mastery.

Your journey from Wall Street to Bowling Green—from ambition to mastery—starts now. You will receive an instant digital download of the complete PDF journal in both sizes. Print as many pages as you need, as often as you want, and start building your trading empire today.

Why You Keep Failing Your Prop Firm Evaluation (And How to Fix It)

You saw the dream, and it was within your grasp. A $100,000, $200,000, or even larger trading account, funded by a proprietary firm. The opportunity to trade with significant capital without risking your own life savings. You studied your strategy, you felt confident, and you dove into the evaluation challenge.

And then, it happened.

Maybe it was a single moment of reckless revenge trading after a frustrating loss. Maybe you grazed the daily drawdown limit by a few dollars. Or perhaps you got so close to the profit target that you took a sloppy, oversized trade and blew up weeks of hard work in a single afternoon.

If this sounds familiar, you are not alone. The path to a funded trading account is littered with the ghosts of failed challenges. The gut-wrenching feeling of being “so close, yet so far” is a story almost every trader knows.

But here is the secret that successful funded traders understand: The majority of challenges are not failed because of a bad trading strategy. They are failed because of a broken process.

You don’t have a strategy problem; you have a discipline, psychology, and tracking problem. And the good news is, that is entirely fixable. In this ultimate guide, we will break down the exact 5-step professional framework you need to implement to stop failing and finally secure your funded account.

The Real Problem: You’re Fighting the Rules, Not the Market

Let’s be clear. The primary objective of a prop firm evaluation is not to test if you have a winning trading strategy. It is to test if you can be a disciplined risk manager. The profit target is simply the reward for proving you can consistently follow a set of non-negotiable rules under pressure.

You fail when you treat the challenge like a normal trading account. You fail when you focus only on the profit and ignore the parameters that are actually being graded. Your framework for success, therefore, must be built entirely around mastering these rules.

The 5-Step Framework to Pass Any Prop Firm Challenge

The 5-Step Framework to Pass Any Prop Firm Challenge

Step 1: Become a Master of the Rules

Before you even think about your first trade, you must know the evaluation rules so intimately that you can recite them in your sleep. Most traders just skim them, but professionals deconstruct them. Let’s look at the main culprits.

Max Daily Loss

This is, without a doubt, the #1 killer of trading challenges. It’s often a fixed percentage (e.g., 5%) of your initial balance. One bad day, one moment of indiscipline, and your challenge is over before it truly began.

How it trips you up: You have a couple of small losses and think, “I can make it back with one big trade.” This “go-for-broke” mentality is what the prop firm is specifically testing to see if you can avoid.

The Fix: Your personal daily loss limit must be significantly smaller than the prop firm’s limit. If the max daily loss is $5,000, your personal “hard stop” for the day should be $2,500 or $3,000. This gives you a buffer for slippage and ensures you live to trade another day. The moment you hit your personal limit, you shut down your platform. No exceptions.

Max Overall Drawdown

This is the second-deadliest rule, and it’s often misunderstood. You must know if your firm uses a Static or Trailing drawdown.

- Static Drawdown: This is simple. If you have a $100,000 account with a 10% max drawdown, your account balance can never drop below $90,000. It’s a fixed line in the sand.

- Trailing Drawdown (The Dangerous One): This is where most traders get into trouble. A trailing drawdown follows your highest account balance (your “equity peak”). If you turn your $100k account into $105k, your new “breach” level also moves up. This means a winning streak can actually put you in a more precarious position if you give back those profits.

The Fix: You must track your equity peak every single day. You need to know, to the dollar, where your new breach level is after every winning trade. Treating a trailing drawdown like a static one is a recipe for disaster.

Profit Target

This is the goal, but it’s also a psychological trap. A 10% profit target can seem daunting, leading traders to take oversized risks to get there faster.

The Fix: Reframe the goal. It’s not about making 10% in a month. It’s about making 0.5% twenty times, or 1% ten times. Break it down into manageable, daily, or weekly goals that align with your proven strategy. This is a marathon, not a sprint. Chasing the profit target is the fastest way to ensure you never reach it.

Step 2: Codify Your ONE Trading Plan

During an evaluation, pressure makes you second-guess everything. You take a loss, and suddenly you’re on YouTube looking for a “better” strategy. This is called strategy-hopping, and it is fatal. You must enter the challenge with a single, clearly defined plan.

A plan in your head is a suggestion; a plan written on paper is a commitment. You need to create your “Trading Constitution,” a document that outlines your non-negotiable rules. It must include:

- Your Market & Session: (e.g., NASDAQ during New York session)

- Your Timeframes: (e.g., 1-hour for trend, 5-minute for entry)

- Your Exact Entry Criteria: (e.g., “Price must break and retest the 50 EMA on the 5-min chart, with RSI below 30.”)

- Your Exact Exit Criteria: (Both for taking profit and cutting a loss)

- Your Risk Management Rule: (e.g., “I will risk no more than 0.5% of my account per trade.”)

The Fix: Before you start the challenge, write these rules down. You must commit to following this plan and only this plan for the entire duration of the evaluation. It is your anchor in the emotional storm of the market.

Step 3: Track Everything That Matters (Especially the Rules)

If you are only tracking your profit and loss in a standard spreadsheet, you are flying blind. To pass a challenge, you must track your performance against the rules that matter. Every single day, you need a crystal-clear, at-a-glance view of your most critical metrics.

This is where a dedicated tracking system becomes non-negotiable. You cannot afford to miscalculate your trailing drawdown or forget how much room you have left on your daily loss limit.

The Fix: Use a tool designed specifically for the visual and mental demands of a funding challenge. You need to see these numbers clearly, every day:

- Your Current Balance vs. Your Profit Target

- Your Current P/L vs. Your Max Daily Loss Limit

- Your Highest Equity Peak vs. Your Max Overall Drawdown

(A mockup image of the Prop Firm Challenge Tracker page is placed here)

A dedicated tracker like this is essential. It instantly tells you if you are in a safe zone or a danger zone, allowing you to adjust your risk accordingly.

Step 4: Actively Manage Your Trading Psychology

You can have the best plan and the best tracking system in the world, but if your mind is not right, you will fail. Fear, greed, euphoria, and frustration are the puppet masters that cause you to break your rules. You cannot eliminate these emotions, but you can learn to manage them.

How? By treating your mind like another market variable that needs to be tracked and analyzed.

The Fix: Start an Emotions & Psychology Log. This is a revolutionary practice for many traders. Every day, you log:

- Your Pre-Market Mood: Are you stressed, tired, focused, anxious?

- The Emotion Before Entry: Were you confident or were you chasing out of FOMO?

- The Emotion After Exit: Did you feel relief after a win? Anger after a loss?

- Confidence & Stress Levels: Rate them on a scale of 1-10.

Over time, you will uncover your patterns of self-sabotage. You might discover that after two big winning trades, you feel euphoric and your third trade is always a reckless, oversized loss. Once you see the pattern, you can create a rule to fix it: “After two consecutive wins, I will take a 30-minute break from the charts.”

(A mockup image of the Emotions & Psychology Log page is placed here)

Master your mind, and the market will follow. Logging your emotions is the first step to conquering the psychological traps that lead to failure.

Step 5: The Non-Negotiable End-of-Day Review

The professional trader’s day doesn’t end with their last trade. It ends with a review. This is where the learning happens. This is where you reinforce good habits and correct bad ones. A consistent end-of-day review is the cornerstone of discipline.

The Fix: At the end of every trading day, answer these simple but powerful questions:

- Did I follow my trading plan on every single trade?

- Did I respect my personal risk limits?

- Did I stay well within the prop firm’s drawdown rules?

- What was one thing I did well today?

- What is one thing I can improve upon tomorrow?

This simple, 10-minute ritual forces you to take accountability. It compounds your learning and accelerates your path to consistency. It turns every trading day, win or lose, into a productive lesson.

Your Blueprint for a Funded Account

Following this 5-step framework—mastering the rules, codifying your plan, tracking what matters, managing your psychology, and conducting a daily review—will transform you from a hopeful amateur into a disciplined professional.

Putting it all together, however, requires a system. Juggling spreadsheets, notebooks, and random thoughts is inefficient and adds to your stress.

That is precisely why we created The Ultimate Trader’s Journal.

It is a complete, 152-page printable ecosystem designed to be the single tool you need to implement this entire framework. It’s not just a planner; it’s your command center for passing your prop firm challenge.

It includes:

- A Dedicated Prop Firm Challenge Tracker so you never violate a rule.

- An Emotions & Psychology Log to keep you calm and objective.

- A Trading Rules Vault to codify your plan.

- Daily, Weekly, & Monthly Planners to structure your routine.

- In-depth Checklists and Review Sheets to enforce discipline.

- Motivational Coloring Pages to de-stress and refocus your mind.

Stop letting simple, preventable mistakes cost you the opportunity of a lifetime. For just $10, you can download the entire system that professional traders use to get funded and stay funded. This isn’t an expense; it’s the single best investment you can make in your trading process.

Frequently Asked Questions

1. Is this a physical planner that will be shipped to me?

No, this is a 100% digital product. Upon purchase, you will receive an instant download link for the PDF files. This means no waiting for shipping—you can print it and start planning your trades today!

2. How will I get my files after I buy the journal?

Instantly! After completing your purchase through our secure Payhip checkout, you will see a download link on the confirmation page. You will also receive an email with a link to download your files at any time.

3. What sizes are included? Do I have to choose one?

No need to choose! We believe in providing maximum value, so your one-time purchase includes the complete 152-page journal in both sizes:

- Full US Letter Size (8.5″ x 11″)

- A5 Style (5.8″ x 8.3″)

You get both files, so you can use whichever format best suits your needs.

4. Can I use this on my iPad or tablet in an app like GoodNotes?

Absolutely. While the journal is designed for the proven benefits of physical writing, the PDF file can be imported directly into any PDF annotation app like GoodNotes, Notability, or Xodo. This allows you to use it as a digital trading journal on your tablet.

5. Is the planner dated? Will I have to buy it again next year?

The journal is completely undated. We designed it to be a long-term tool for your trading career. You can print the pages as many times as you want, for as many years as you want. It’s a single purchase for a lifetime of use.

6. Why should I use this instead of a free spreadsheet?

Spreadsheets are great for logging data, but this journal is a system designed to build discipline and master psychology. The physical act of writing down your rules, goals, and emotional state creates a powerful psychological connection that a spreadsheet cannot replicate. Furthermore, it integrates unique tools spreadsheets don’t have—like the prop firm tracker, psychology logs, checklists, and de-stressing coloring pages—into one cohesive system for peak performance.

7. Is this journal good for trading Forex / Crypto / Stocks?

Yes! The principles of professional risk management, disciplined execution, and emotional control are universal to all markets. Whether you trade Forex, crypto, stocks, futures, or indices, the tools inside this journal will help you improve your process and consistency.

8. What is your refund policy?

Due to the instant, digital nature of this product, all sales are final and non-refundable. We have provided a comprehensive description and detailed images so you can be confident that this journal is the right tool for you before purchasing. If you have any trouble accessing your files, please contact us and we will be happy to help.