Ultimate Trading Journal Sheets

Discover the Ultimate Trading Journal Features

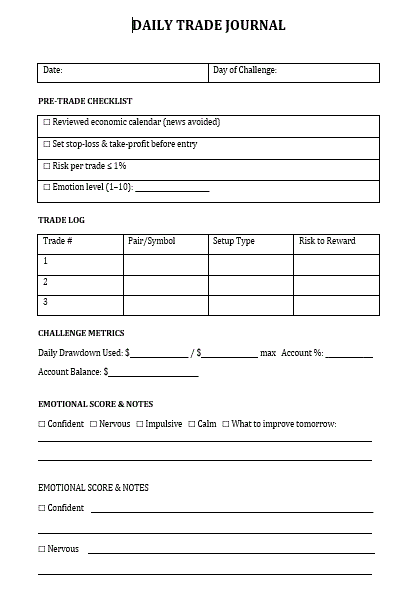

Daily Trade Journal ………

$.50

✔️ What’s Included:

- ✅ Pre-Trade Checklist (with emotional readiness & risk controls)

- ✅ Trade Log Table for up to 3 trades (symbol, setup, risk-to-reward)

- ✅ Daily Drawdown & Account Balance Tracker

- ✅ Emotional Check-In with clear prompts

- ✅ Space to reflect on what to improve tomorrow

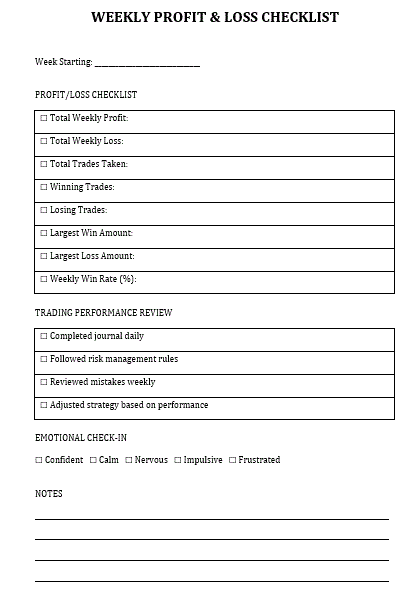

Weekly Profit & Loss Checklist

$.50

✔️ What’s Included:

- ✅ “Week Starting” tracker

- ✅ Totals for trades, wins, losses, and profit/loss

- ✅ Performance Review with simple checkboxes

- ✅ Emotional Check-in (Confidence, Calm, Stress, etc.)

- ✅ Lined Notes section for reflection & improvements

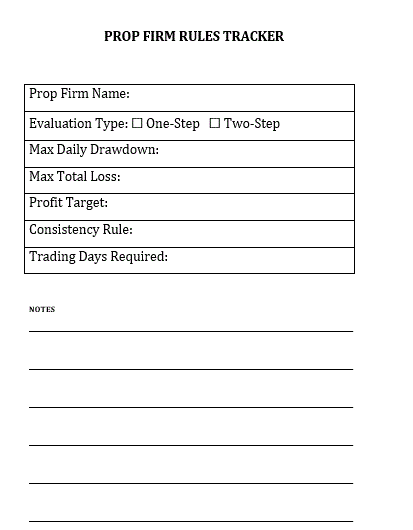

Prop Firm Rules Tracker

$.50

✔️ What’s Included:

- ✅ Firm name & evaluation type (One-Step or Two-Step)

- ✅ Max daily drawdown & total loss fields

- ✅ Profit target and consistency rule tracker

- ✅ Trading days required

- ✅ Notes section for custom rules or firm-specific tips

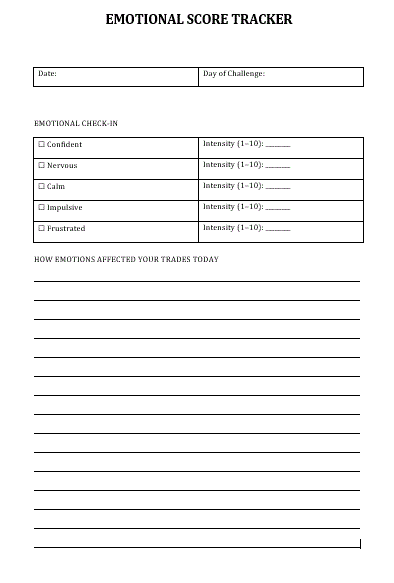

Emotional Score Tracker

$.50

✔️ What’s Included:

- ✅ Daily entry for date & challenge day

- ✅ Emotional check-in (Confident, Nervous, Calm, Impulsive, Frustrated)

- ✅ Intensity rating scale (1–10) for each emotion

- ✅ Reflection space to evaluate how emotions impacted your trades

Track Your Trades Today

Unlock powerful trading journal sheets to enhance your trading performance.

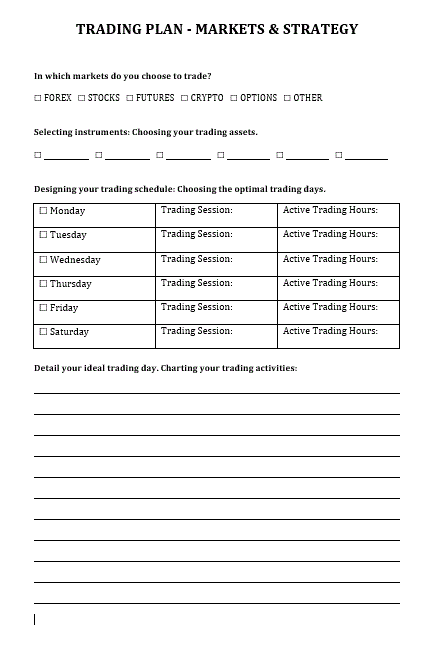

Trading Plan Markts & Strategy

$.50

✔️ What’s Included:

✅ Guided section to map out your ideal trading day

✅ Market checklist (Forex, Stocks, Futures, Crypto, Options, Other)

✅ 6 customizable asset selection checkboxes

✅ Weekly trading schedule: pick your days, sessions, and hours

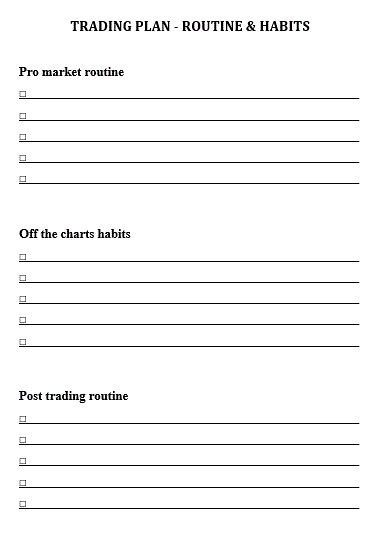

Trading Plan Routine & Habits

$.50

✔️ What’s Included:

- ✅ Pre-market routine checklist to prepare mentally and technically

- ✅ Off-the-charts habit tracker (journaling, mindset, reflection)

- ✅ Post-trading routine to stay accountable and emotionally in control

- ✅ Lined space to customize routines based on your needs

Trade Review Worksheet

$.50

✔️ What’s Included:

- ✅ Space to log trade number, date, symbol, and setup

- ✅ Record stop loss, take profit, and risk-to-reward ratio

- ✅ Checkboxes for trade result: Win, Loss, or Break-even

- ✅ Prompts for noting mistakes, emotional state, and lessons learned

- ✅ A section for planning future improvements

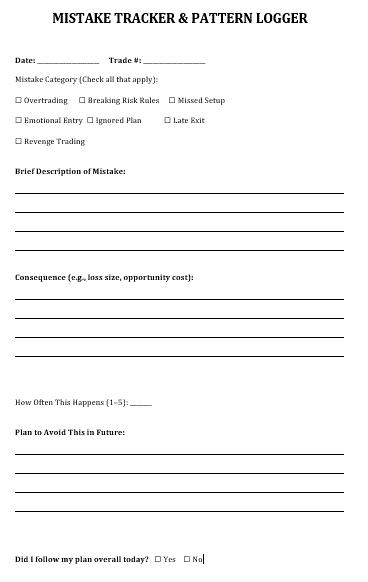

Mistake Tracker & Patern Logger

$.50

✔️ What’s Included:

- ✅ Date & trade number fields

- ✅ Common trading mistake checkboxes (overtrading, revenge trading, emotional entries, etc.)

- ✅ Space to describe each mistake and its consequences

- ✅ Frequency scale (1–5) to monitor repeated errors

- ✅ Action plan section to correct and prevent mistakes

- ✅ End-of-day “Did I follow my plan?” checkpoint

Master Every Trade

Streamline your trading with precision-built journal sheets designed for prop firm success.

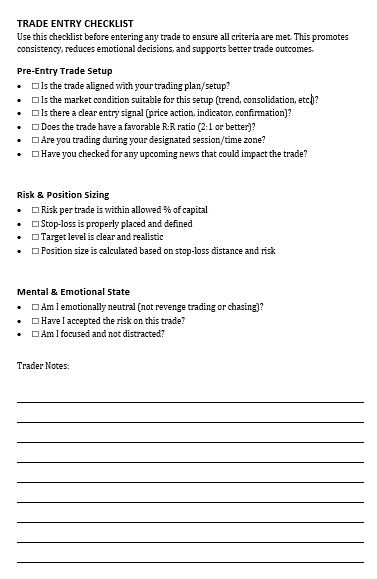

Trade Entry Checklist

$.50

✔️ What’s Included:

✅ Setup confirmation prompts (strategy match, session time, entry signal)

✅ Market condition checklist (trend, volatility, upcoming news)

✅ Risk validation (stop-loss, position size, R:R ratio)

✅ Emotional readiness check (focus, confidence, acceptance of risk)

✅ Blank “Trader Notes” section for personal reflection or reminders

Trades Notes Notebook Style

$.50

✔️ What’s Included:

✅ Stylized header for “Trade Notes” to keep your journal organized

✅ 24 spacious, lined sections for free-form notes

✅ Minimal design to reduce clutter and enhance focus

✅ Use for trade recaps, strategy ideas, market reflections, and more

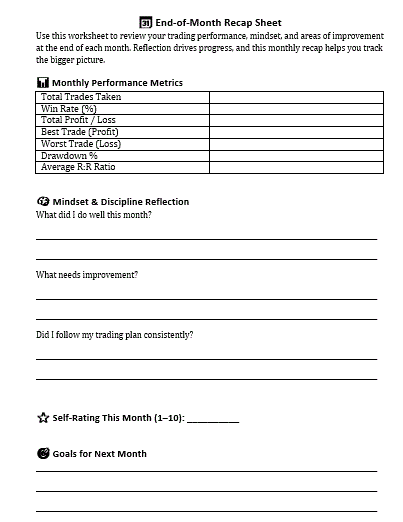

End of Month Recap Sheet

$.50

✔️ What’s Included:

✅ Monthly performance metrics section (trades taken, win rate, P/L, drawdown, etc.)

✅ Reflection prompts for strengths, weaknesses, and plan adherence

✅ Self-rating field to assess discipline and execution

✅ Space for next month’s goals and focus areas

Daily Trader Affirmation Checklist

$.50

✔️ What’s Included:

✅ Morning affirmations checklist to start your day focused and strong

✅ Midday affirmations to reset and stay calm under pressure

✅ Evening reflection space to write your own personalized affirmation

✅ Clean checkbox format for building daily mental habits

The Power of a Trading Journal: Why Every Trader Needs One

If you’re serious about improving as a trader, especially in the high-pressure world of prop firm evaluations and funded accounts, using a trading journal is not just helpful — it’s essential. A well-structured trading journal does more than just record your trades. It enhances your discipline, reveals patterns in your behavior, and helps you grow into a smarter, more profitable trader.

In this article, we’ll explore why a trading journal can dramatically improve your performance, and we’ll walk you through eight powerful journal templates designed specifically for prop firm traders, all available in our Ultimate Trading Journal Sheets collection.

Why Use a Trading Journal?

Increased Accountability

When you’re logging each trade and tracking your reasoning, it’s much harder to justify impulsive decisions. Journaling keeps you accountable to your strategy and risk management rules. It forces you to reflect on your performance and take ownership of both wins and losses.

Better Risk Management

Journals allow you to track metrics like stop losses, take profits, R:R ratios, and daily drawdowns. By reviewing this data regularly, you can catch bad habits and make informed adjustments to protect your capital.

Emotional Awareness

Trading is as much psychological as it is technical. A good journal helps you identify emotional triggers—like fear, greed, or frustration—and how they affect your performance. Over time, this self-awareness leads to more disciplined and consistent trading behavior.

Strategy Refinement

When you record your setups, results, and lessons learned, you build a data-driven picture of what works and what doesn’t. You can tweak and refine your trading strategies over time based on actual evidence, not just gut feeling.

Goal Tracking

Many traders set goals but don’t monitor their progress. Journaling allows you to track KPIs like win rate, consistency, weekly P&L, and more. It gives you measurable benchmarks to stay on target and stay motivated.

Level Up Your Trading with These Powerful Journal Tools

A trading journal isn’t just a notebook for numbers — it’s your blueprint for growth. It’s how professional traders reflect, refine, and evolve. And if you’re serious about getting funded or staying funded, it should be your #1 daily tool.

Reveals Performance Trends

Without tracking your numbers and reviewing your performance regularly, it’s impossible to see the big picture. Are you profitable over the long term? Which days of the week are strongest for you? When are you most likely to make mistakes?

The Weekly Profit & Loss Tracker is your tool for catching these patterns. It totals your wins and losses, calculates your win rate, and gives you a weekly pulse on how you’re progressing. It includes space for rating your consistency and writing down key takeaways — because performance without review is just noise.

This kind of overview is essential, especially when you’re managing drawdown limits during prop firm evaluations.

Avoid Costly Rule Violations

One of the biggest reasons traders fail prop firm evaluations isn’t strategy — it’s breaking simple rules like hitting max drawdown or missing minimum trading days.

Our Prop Firm Rules Tracker helps prevent that. This printable page lets you document every key parameter of the firm you’re trading with — from the profit target to the daily loss limit. When you see these numbers every day, they stay top-of-mind, and you’re much less likely to make rule-breaking mistakes.

Think of it as your trading rulebook — custom-built for your firm, on your desk, every day.

Become Emotionally Self-Aware

Emotions can sabotage even the most skilled traders. A fear-based exit, revenge trade, or overconfident entry can turn a solid day into a disaster. The difference between pros and amateurs? Pros know their triggers.

That’s where the Emotional Score Tracker comes in. This journal sheet prompts you to check in with yourself before, during, and after the trading day. You’ll rate emotions like anxiety, frustration, or confidence, and reflect on how they influenced your decisions.

Over time, you’ll begin to see emotional patterns. And when you can name them, you can manage them — which gives you a serious edge.

Learn More from Each Trade

Every trade is a lesson — but only if you capture the details. What setup did you use? Was your R:R realistic? Did you enter too early or too late? Was your mindset sharp?

The Trade Review Worksheet is your space to answer all of these questions. It helps you unpack the full context of each trade: what worked, what didn’t, and what to do differently next time. This is how you build a playbook that works — not based on theory, but on your own performance.

Eliminates Repeating Mistakes

Everyone makes mistakes — but smart traders don’t keep making the same ones. The problem? Most people aren’t logging them clearly.

The Mistake Tracker & Pattern Logger gives you space to identify exactly what went wrong, how often it happens, and how to avoid it going forward. With checkboxes for common errors like overtrading, breaking rules, or revenge trading, this worksheet helps you isolate bad habits and build better ones.

If you’re tired of blowing progress with repeat mistakes, this tracker will become your favorite page.

Builds Confidence

The more you understand your own trading — what works, what doesn’t, and why — the more confident you become. You stop second-guessing. You stop flipping strategies. You start showing up with a system, a mindset, and a plan.

Journaling builds that confidence. And confidence, in the prop firm world, is what separates the passers from the re-takers.

- About

- Cart

- How to Pass a $1,500 Prop Firm Futures Challenge in 10 Days

- How to Stop Overtrading and Stay Funded: What Every Trader Needs to Know

- Privacy Policy

- Prop Firm Digital Trading Planner (iPad Compatible – GoodNotes Ready)

- The Ultimate Trader’s Journal The Wall Street to Bowling Green Edition: A Printable Financial Planner for Market Mastery

- Trader’s Monthly PnL Tracker